How to Destroy an Empire

“The Federal Reserve sets two overnight interest rates: the interest rate paid on banks’ reserve balances and the rate on our reverse repurchase agreements. We use these two administered rates to keep a market–determined rate, the federal funds rate, within a target range set by the FOMC.”

Jerome Powell, Chair of the Federal Reserve

“The Fatal Conceit – the arrogant belief that a single institution actually possesses the requisite knowledge to manage such a complex economic system”.

Fredrick Hayek(1899 – 1992)

INTRODUCTION

The 2nd National [central] Bank of the United States (US) was established in 1816 by James Madison, 4th President of the US (1809 – 1817). After his election in 1832, Andrew Jackson, 7th President of the US (1829 – 1837), ordered that all federal deposits be removed from the National Bank and deposited into state banks. Andrew Jackson distrusted the National Bank as he felt it trampled on state rights and concentrated financial power in the hands of a few wealthy citizens without an effective regulatory system. He felt the National Bank was “created to serve the interest of the wealthy, not to meet the Nation’s financial needs”. In April 1834, the House of Representatives voted against rechartering the National Bank. It was 79 years before the US established another “central bank”.

In the autumn of 1910 a group of five wealthy bankers, one US Senator, and the Assistant Secretary of the US Treasury, met in secrecy on Jekyll Island, Georgia with the sole objective to create a “bankers bank” and “lender of last resort”. This clandestine meeting of the politically powerful and wealthy bankers included the following incestuous and self-serving participants1.

- Nelson W. Aldrich, Republican “whip” in the Senate, Chairman of the National Monetary Commission, business associate of J.P. Morgan, father-in-law to John D. Rockefeller Jr.;

- Abraham Piatt Andrew, Assistant Secretary of the US Treasury;

- Frank A. Vanderlip, president of the National City Bank of New York, one of the biggest banks at this time, representing William Rockefeller, and the international banking house of Kuhn, Loeb & Company;

- Henry P. Davison, senior partner of the J.P. Morgan Company;

- Charles D. Norton, president of J.P. Morgan’s First National Bank of New York;

- Benjamin Strong, head of J.P. Morgan’s Bankers Trust Company;

- Paul M. Warburg, a partner at Kuhn, Loeb & Company, a representative of the Rothchild banking dynasty in England and France, and brother to Max Warburg who was head of the Warburg banking consortium in Germany and the Netherland.

The framers of this secretive meeting had the following self-serving objectives in mind:

- Stop the formation of small local banks to eliminate the competition as a means to ensure control over the nation’s financial resources remains with the big commercial banks (i.e., J.P. Morgan).

- Stop the trend toward private capital formation. Create a trend to eliminate “thrift” and instill “debt” to recapture the industrial loan market.

- To create a centralized money system, a “bankers-bank”, an explicit and implicit “lender of last resort”, the purveyor of money creation without liability (i.e., pass the financial liability to the taxpayer).

- By creating a national “central bank” whereby all the liability, in the event of the monetary collapse of the banking system, could be shifted to the taxpayers versus the owners of the banks.

The secret meeting on Jekyll Island resulted in the creation of the 3rd Central Bank of the US called the Federal Reserve System (1913 – Present) (the “FED”)2 and the passage by the US Congress of The Federal Reserve Act (the “ACT”)3 which was signed into law by President Woodrow Wilson (1913 – 1921) on December 23, 1913.

The FED was specifically created to redirect any financial liability from the commercial and investment banking industry to the US tax payor. Since its creation, the FED has used its autonomy granted to it by the Federal Reserve Act, to bypass Congressional oversight with regard to its “monetary policy” decisions, to be the “bankers bank”, the “lender of last resort” for the “Banking Industrial Complex” and “Wall Street” leaving “Main Street” to pay for this egregious, self-serving dysfunctional activity through taxes, economic downturns, wage inequity and wage stagnation of the working middle-class American, the destruction of the savings rate, and Dollar devaluation (inflation).

Ron Paul4, former US Congressman from Texas and Founder of the Ron Paul Institute, states in his book “End the Fed” (2009) that “the FED is nothing more than a Bankers club, both corrupt and unconstitutional”. We need to END THE FED.

PROLOG

For the reader to fully comprehend the symbiotic events described in this writing, it is important to understand the economic meaning and the financial and societal impact of the following terms:

MONEY – Money has three main components:

- Money is a medium of exchange, which means a universally accepted unit (currency) that allows people and businesses to buy and sell in a marketplace.

- Money is a unit of account, meaning it is an accepted standard unit from which things are priced (dollar amount).

- Money needs to be a store of value, meaning it can be measured alongside (and if need be, exchanged for) an alternative quantifiable commodity (such as, gold, silver, copper, etc.) having explicit and implicit “intrinsic value”5 assigned to it by the marketplace.

The Federal Reserve Act of 1913 designated the FED as the “central banking” authority and fiscal agent of the US Government, and, in theory, directly accountable to Congress. Then and now, money (paper money or currency) in the US is the dollar (the “Dollar”) issued by the FED as Federal Reserve Notes6. Federal Reserve Notes, like all notes, are a government obligation, a form of debt, a contract signed by the US Secretary of the Treasury and the FED on behalf of the people. This “debt” is unique as it bears no interest and has no maturity date. By law, the Dollar must be accepted as payment for all debts and taxes; hence, “money by decree” or “legal tender”.

Historically, money has always been defined within the context of a “gold standard”, the foundation for “sound money principals”, hence the basis for the International Monetary System7 from the 1873 until 1933 (Barry Eichengreen8). After the Federal Reserve Act in 1913, Federal Reserve Notes (Dollars) were redeemable by US citizens and foreign Dollar reserve holders into physical gold at $20.67 per ounce. As a result of WWI’s (1914 – 1918) global monetary and debt expansion and the post-war massive money printing and expansion of the money supply by the FED, the Bank of England (Great Britain’s central bank) in September 1931 abandoned the gold standard. Following close behind and commensurate with the Great Depression (1929 – 1941), President Franklin D. Roosevelt in March 1933 declared a national bank moratorium (bank holiday) to prevent massive Dollar withdrawals by citizens from banks and forbid banks to export or redeem gold for Dollars to US citizens and foreign reserve holders. This “bank holiday” was followed by Roosevelt’s Executive Oder # 6102 on April 5, 1933, with the seizure of all privately owned physical gold, making gold ownership illegal for all US citizens and private enterprise. Privately owned physical gold was redeemed by the FED “from money created out of nothing” at the rate of $20.67 per ounce, followed by the FED repricing the Dollar at $35.00 per ounce (Dollar devaluation). This Dollar convertibility, from $20.67 per ounce to $35 per ounce gold, represented a 40% devaluation of the Dollar. Another form of gold price manipulation by the government, discussed more below.

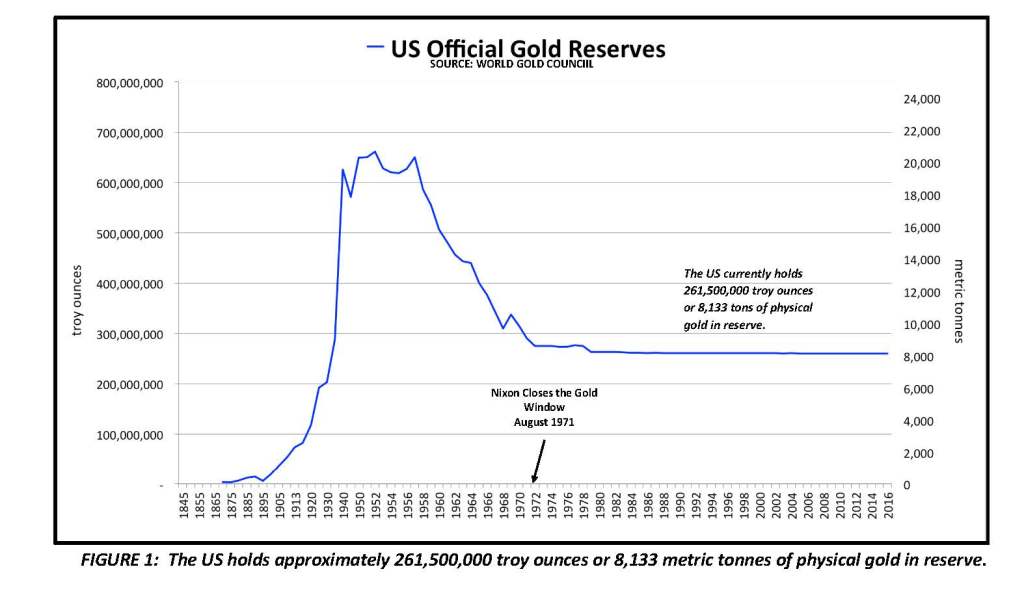

Following the seizure of all privately owned gold in April 1933, Congress passed the Gold Reserve Act of 19349 on January 30, 1934, which removed convertibility of the Dollar to gold at $20.67 (“gold backed Dollar”) and nationalized all gold held by the FED, requiring the Federal Reserve Banks to turn over all physical gold to the US Treasury in exchange for “gold certificates”10 (Series of 1934) valued at $35 per ounce. As a result of this legislation, gold imports climbed sharply, increasing the holdings by the US Treasury from 6,358 metric tonnes in 1930 to 19,543 metric tonnes of fine gold by 1940 (Green, Timothy Central Bank Gold Reserves, November 1999)11.

After WWII, in July 1944, 730 delegates from 44 nations met at Bretton Woods, New Hampshire for the United Nations Monetary and Financial Conference (the “Bretton Woods Conference”). The main purpose of the conference was to establish a new International Monetary System known as the Bretton Woods System12 (Bretton Woods International Monetary Agreement of 1944). The Bretton Woods System created a “pseudo gold standard”, termed the “gold exchange standard”13, whereby the delegate nations agreed to accept the Dollar as a “reserve currency” (replacing the pre-WWII British Pound Sterling) and the US Government pledged to convert foreign Dollar reserve holdings into gold at a fixed rate of $35 per ounce. This resulted in a “fixed currency exchange rate system”14whereby foreign currencies were pegged to the Dollar and the Dollar was pegged to gold convertibility at $35 per ounce. Unfortunately, this was without individual citizens or domestic convertibility and all US citizens were prohibited from owning gold.

The Bretton Woods Conference also established the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD). The IBRD focused on post war reconstruction and development and has since been consolidated into the World Bank Group. The IMF serves as the financial agency for the United Nations (UN), designated, among other things, to assist in the recovery of international financial crises and support exchange rate stability (the “global lender of last resort”). The IMF, at its inception had 29 member countries with a goal to reconstruct the international monetary currency system after World War II and after Britain abandoned the gold standard and thereby replacing the British Pound Sterling as the global reserve currency with the US Dollar. Although the IMF is officially part of the UN, it operates independently and is funded separately by 190 member countries based on a quota system. In 1969 the IMF created the Special Drawing Right (SDR), an international reserve asset to “supplement” its member countries official reserves (“money created out of nothing”). The value of the SDR is based on a basket of five currencies: US Dollar, Euro, Chinese Renminbi, Japanese Yen, and British Pound. To date, the IMF has allocated a total of SDR 660.7 billion or US$ 935.7 billion (more on this below). The establishment and structure of the Bretton Woods System, the IBRD and the IMF were based on the ideas of Harry Dexter White and John Maynard Keynes, not the Austrian School (discussed below), hence the root of all our monetary problems today (more on this below). [Note: this is laughable as the IMF was formed to fix what they all created, resulting in making the international banking system more State controlled, consisting of more monetary gimmicks…. “The Fatal Conceit”].

In the early 1960’s the market price of gold on the London Gold Exchange15 started rising against the $35 Dollar per ounce gold peg. To maintain the Bretton Woods System and defend (manipulate) the “gold exchange standard” of US$35 per ounce, the London Gold Pool16 was established on November 1, 1961. The London Gold Pool involved the “pooling” of physical gold reserves by the FED in collaboration with seven European central banks (i.e., West Germany, France, Switzerland, Italy, Belgium, Netherland, and Luxembourg). This cabal of central bankers coordinated the manipulation of the “free market” price of gold by intervening (selling physical gold against open market orders) into the London Gold Market. The manipulation of the gold price in this manner was successful for six years until the pegged price at US$35 per ounce of gold became unmanageable, depleting the London Gold Pool inventory (predominantly the US gold reserves) (Figure 1) resulting in the market price of physical gold rising above the $35 per ounce Dollar peg. In June 1967, France, under President Charles de Gaulle, withdrew from the London Gold Pool and, as part of this decision, began more aggressively redeeming France’s Dollar reserves into gold. Subsequently, the London Gold Pool collapsed in March 1968. Other efforts to suppress and manipulate the gold price using a two-tier system of currency exchange rates also failed in 1971.

Following the collapse of the London Gold Pool in 1968, on August 15, 1971, President Richard Nixon (1969 – 1974) closed the “US gold window”, terminating (defaulting on its promise) the convertibility of foreign central banks Dollar holdings (reserves) to gold at a fixed rate of $35 per ounce. This decision effectively ended the Bretton Woods System and the “intrinsic value” of the Dollar.

The trigger to this culminating event, termed the “Nixon Shock”, was the result of substantial money printing by an out-of-control FED (debt monetization). This unfunded US Government spending spree created excessive Treasury Security deficits in support the Vietnam War (1963 – 1975)17 and other unfunded domestic programs, such as “the Great Society”18 enacted by President Lyndon Johnson (1963 – 1968) and then followed by President Richard Nixon (1969 – 1974), enacting income guarantees and other unfunded revenue sharing programs (Note: Lyndon Johnson became President following the assignation of President John F. Kennedy on November 22, 1963 and President Richard Nixon resigned just prior to his impeachment proceedings ended due to the Watergate scandal, in August 20, 1974. Upon resignation of Nixon, Gerald Ford, then Vice President, became the 28th President of the US, lasting until January 20, 1977).

Since the US Dollar was pledged and pegged at a fixed and redeemable value in terms of gold and accepted as the global reserve currency in 1944, the major western central banks (primarily Britain and France), became concerned that the increase in the unfunded annual US debt and, for the first time, a balance of payment trade deficit would result in a major decrease in the value of the Dollar to gold convertibility (i.e., inflation=devaluation). Consequently, foreign Dollar reserve redemptions for physical gold by the British and French central banks occurred and then accelerated from 1959 – 1970 (Figure 1).

Consequently, the redemption of foreign held Dollar reserve from 1959 to 1971 reduced the US physical gold reserves from over 20,000 metric ton to 8,133 tons of gold (261,500,000 troy ounces AU) when Nixon closed the “gold window”, a 60% decline in the US gold reserve (Figure 1). Following the “Nixon Shock” and the failure of the FED to reestablish a new Dollar gold peg, in October 1976 the US Government officially changed the definition of the Dollar thereby removing all reference to gold and gold convertibility. The Dollar from 1971 forward has become “fiat”19 money as part of the “floating rated currency exchange system”20 of the G7 currencies (Germany, France, Italy, Japan, United Kingdom, United States and Canada). The value of the US gold reserve today was set at $42.22 per troy ounce by law in 1973. Gold ownership by US citizens remained illegal since 1933 until President Gerald Ford on December 31, 1974, (Public Law 93-373) rescinded the 40-year ban, again legalizing physical gold ownership for US citizens.

FRACTIONAL RESERVE BANKING – This scheme allows “Banks”(defined in this writing as all depository institutions, commercial and investment banks) to lend and then collect interest on loans to third parties (such as the public, corporations, or other financial institutions), using your deposit account(s) (time deposits and/or demand deposits). Fractional Reserve Banking is an institutional process of “renting” out your money for a fee. The stated purpose of “fractional reserve banking” is to facilitate lending, expand the M2 money supply21 and theoretically promote economic growth. Globally, all Banks operate on a “fractional reserve” system. Fractional reserve banking is more profitable than other businesses due to the near zero cost of capital and the fact that Bank earnings are compounded several times by continuing to lend (pyramid) the same capital, i.e., the creation of revolving debt. Fractional reserve banking activity is always eventually abused due to over leveraging (lending the same Dollar many times) by Banks.

To prevent Banks from loaning 100% of their deposits (or worse, leveraged to a much higher percentage as discussed below), The National Bank Act of 186322initially required the Banks to maintain a reserve ratio of 25% on deposit to facilitate bank withdrawals by the public. The reserve requirement by the FED has varied through time from a low of 7% to as high as 17.5%. At the time of this writing, the reserve requirement by Banks is 0% of bank deposits (more on this below).

Fractional Reserve Banking has been the root cause, either directly or indirectly, of all economic down turns (depressions and recessions domestically and globally), due to over leveraging of bank deposits, resulting in loan “pyramiding” (lending the same Dollar many times). These loan practices eventually trigger public loss of Bank credibility resulting in “bank runs” (get your money before it is all gone). In today’s world, more egregious silent and less transparent schemes have created complex highly leveraged loan products and securitization, such as Mortgage-Backed Securities(MBS) and Collateralized Debt Obligations (CDO) created during subprime home mortgage market from 2000 – 2008 (more on this later).

INTEREST RATES – The Federal Discount Rate (FDR)23is the interest rate the FED charges Banks for loans , typically referred to as the “Discount Window”, to meet their short-term liquidity issues or reserve requirements. The term of these loans’ ranges from overnight to 30 days (albeit habitually rolled over) and are typically collateralized by other Treasury Securities24 (this would be like collateralizing your car loan with your over extended line of credit). The FDR is the basis for pegging all short-term interest rates and is arbitrarily set by the FED’s Board of Governors. The Federal Funds Effective Rate (FFER)25 is a volume-weighted interest rate calculated based on overnight loan transactions between Banks to satisfy their short-term obligations. The FFER is published by the New York FED daily at 9:00 AM EST. These are collateralized loans, consisting mostly of Treasury Securities, made between Banks or other depository financial institutions, and are determined by the FFER overnight market. The FFER is generally slightly lower than the FDR, albeit directly (manipulated) related to the Federal Open Market Committee’s “target discount rate” (FDR). The Prime Rate26 is the interest rate charged on loans to the public (car loans and/or home mortgages). The Prime Rate is determined (arbitrarily) by the Banking industry and generally set at 3% above the FFER. The Prime Rate is typically a base rate charged on loans to customers with a high credit rating. At the time of this writing, the FFER is 5.40%, the FED’s Discount Rate (FDR) is 5.50% and the Bank Prime Rate is 8.50%. Therefore, the interest rate charged to the public on a typical car loan or home loan could be as high as 11% to 13%, depending on your credit score.

The interest rates on longer-term loans, ranging from 30 days to 30 years, are influenced by the sale of Treasury Securities in the “open market”. These rates are not directly manipulated by the Federal Reserve (FED), but they can be indirectly influenced, as we will discuss later.

To provide some context, Treasury Securities are debt obligations of the US government. They are issued to address shortfalls in government operations that are not covered by tax collections. The sale of Treasury Securities is facilitated by the FED through its system of Primary Dealers.

Primary Dealers are approved Banks, including commercial and investment banks, as well as other depository institutions, both domestic and foreign. These institutions operate as direct and indirect buyers of Treasury Securities. They play a crucial role in the Treasury auction process and support the resale of Treasury Securities in the “aftermarket” through the FED’s Open Market Operations (OMO).

Open Market Operations can be considered a quid-pro-quo scheme designed to ensure the Federal Government’s funding. Through OMO, the FED purchases and sells Treasury Securities in the open market. When the FED buys Treasury Securities, it injects money into the financial system, thereby increasing the money supply. Conversely, when the FED sells Treasury Securities, it absorbs money from the financial system, reducing the money supply.

By influencing the money supply, the FED indirectly affects the interest rates on longer-term loans. When the FED increases the money supply by purchasing Treasury Securities, it can lead to a decrease in interest rates. On the other hand, when the FED reduces the money supply by selling Treasury Securities, it can result in an increase in interest rates.

It is important to note that the FED’s influence over interest rates is not absolute. Other factors such as market demand, inflation expectations, and global economic conditions also play a significant role in shaping interest rates on longer-term loans. Nonetheless, the sale of Treasury Securities through the open market is a key mechanism through which the FED can indirectly impact these rates.

In summary, while the FED does not directly manipulate the interest rates on longer-term loans, its sale of Treasury Securities in the open market can have an indirect influence. The actions of Primary Dealers and the FED’s Open Market Operations play vital roles in facilitating the sale and resale of Treasury Securities, which in turn can affect the interest rates on these loans.

INFLATION – Inflation is a complex and multifaceted economic phenomenon that often eludes a complete understanding, not only for the layperson but for many economists as well. The term “inflation” finds its origins in the Latin word “inflare,” meaning “to blow up or inflate,” and its initial usage dates back to 1838, specifically in reference to the devaluation of currency, as per the Oxford English Dictionary (1989). Interestingly, the concept of inflation first emerged in the United States during the mid-nineteenth century, but not in relation to the fluctuation of prices for goods and services, as one might assume. Instead, it denoted the consequence of the diminishing purchasing power of paper currency.

In essence, inflation can be understood as a result of currency devaluation when there is no underlying commodity backing. In other words, it signifies a decrease in the value of money that subsequently leads to a general rise in prices. This intricate interplay between currency devaluation and the subsequent impact on prices has significant implications for various aspects of the economy, such as business decisions, investment strategies, and consumer behavior.

Understanding inflation is fundamental for both policymakers and individuals alike. Governments and central banks closely monitor inflation rates to implement appropriate monetary policies and strive for a stable economic environment. Additionally, individuals need to comprehend inflation’s effect on their purchasing power and long-term financial planning. This comprehension can help in making informed decisions regarding saving, investing, and budgeting, all of which play crucial roles in maintaining financial well-being amid the ever-changing economic landscape.

It is worth noting that inflation is influenced by a multitude of factors, including government fiscal policies, supply and demand dynamics, international trade, and even psychological factors such as consumer expectations. These factors contribute to the complexities surrounding inflation and further emphasize the challenges that economists face in accurately predicting its behavior and implementing effective measures to manage it.

In summary, inflation is a concept that extends beyond a mere fluctuation of prices. It encompasses the erosion of the value of money and its impact on the entire economic ecosystem. By delving into the historical roots and underlying mechanisms of inflation, we can develop a deeper understanding of this intricate phenomenon and its significance in shaping our economies and our lives.

Today, inflation is dogmatically described by the FED, economists, and legacy news media as an increase in the prices of goods and services in an economy, highlighting the value of production as determined by the increased cost of labor and materials. The inflation narrative is always prosaically aimed and mysteriously blaming rising prices of goods and services by either higher labor costs, supply shortages or increased demand, overlooking Inflations real connection to the “price of money” and the FED’s flagrant money printing and unsupported expansion of the money supply. As stated by the Austrian School, “any increase in the money supply not supported by an increase in the production of goods and services leads to an increase in prices”. Most economists and legacy media ignore the reality that rising costs of goods and services is the result of currency devaluation.

AUSTRIAN VIEW – SOUND MONEY PRINCIPALS – FREE MARKETS The Austrian School30 defined “sound money” (Sound Money Principals31) as money that has a purchasing power determined by markets, independent of central banks, governments, and political parties. A true “gold standard”32is one example of “sound money”, that provides intrinsic value determined by markets rather than the deception of value promoted by governments. The “Regression Theorem”33 put forward by Ludwig Von Mises (1912), states “that the acceptance of an object as a medium of exchange must first have a history of being in demand and exchanged as a nonmonetary commodity with a recognized value in a free market system”. Historically, precious metals (gold, silver, or other metals in high demand per unit of weight) have stood the test of time above other commodities, thereby, having been established with a stable demand and value before these metals started being used as money. “Sound money principals” were not invented but evolved as a classical libertarian process to restrict government power. The argument for sound money is not merely an economic debate but a political and even constitutional argument and “It is analogous to the rule of law”. Hence, money cannot be created out of nothing (“printing press money”) or decreed through social or legal contract.

KEYNESIAN VIEW Opposing “sound-money principles”, the Keynesian View is a macroeconomic theory developed by British economist John Maynard Keynes34 during the 1930s to understand the Great Depression35(1929-1939). The central belief of Keynesian economics is that monetary intervention by governments and the central bank can stabilize and promote economic growth and employment. This means that direct government funding of programs (i.e., typically in the form of education, health, public works, infrastructure programs), using taxpayer and “money created out of nothing” by central banks through the purchase and sale of Treasury Bonds (debt). The Keynesian view encourages the use of fiscal and monetary policies deployed by government to manage the economy, thereby giving the “State” (central government and central bank) a pivotal role in manipulating interest rates and employment through a variety of money management and money creation schemes. Further, the Keynesian economic view is top-down, central planning, and socialistic in its approach to managing the economy.

Although the Austrian School’s “sound money” economics have seen a revival in the 21st century, the FED and US Treasury have been staunch supporters of the Keynesian economic views for decades and, more recently, support an ideology that government deficits, debit, low interest rates and endless money printing doesn’t matter; a far-left progressive insidious and egregious neoliberal idea termed: Modern Monetary Theory (MMT)36 (more later).

FEDERAL RESERVE SYSTEM

The FED is a highly misunderstood government organization due to its complex structure and mix of private and government operations. This confusion is exacerbated due to the lack of transparency. The FED has always carried the false distinction of being “independent”, inferring that it independently maintains the integrity of the Dollar without congressional or political influence. The FED purports to operate in a regulatory capacity to “ensure the quality of commercial and private banks and authority over the nation’s payment system and particularly money creation”. This untruth has been mendaciously and insidiously promoted by the FED (and others in the private banking sector) and believed by the public as an honorable American and capitalistic concept. However, the FED’s “independence” stems solely from its authority granted to it by the Federal Reserve Act to create Monetary Policy schemes, bypassing Congressional approval and oversight, hence enabling it to “create money out of nothing” to fulfil its mandate as the “lender of last resort” for “Wall Street” and the “banking industrial complex”. Over time, the operations and opaque activities of FED has created a neoliberal plutocracy, whereby the wealthy top 1% of the population (the “elite”) control the government.

The FED consists of three parts: (1) Board of Governors made up of 7 members nominated by the President and confirmed by the US Senate; (2) Federal Reserve Banks, consisting of 12 separate, self-funding and privately incorporated regional banks located in 12 major cities throughout the US and; (3) the Federal Open Market Committee (FOMC), consisting of 12 members, made up of the Board of Governors (7 members), the President of the New York Federal Reserve Bank (1 member) and 4 other members, made up of presidents of the regional Federal Reserve Banks. The FED Chairman heads up the Board of Governors and the FOMC; and is appointed by the President and approved by the US Senate.

The FED has been given a dual mandate by Congress: (1) maintain maximize employment that the economy can sustain over time and (2) maintain price stability. Maintaining ‘price stability’ means keeping “inflation” low and stable over time. Currently, the FED “seeks to achieve inflation that averages 2 percent over time”. To achieve these goals the FED has established a “Monetary Policy”37 that consists of a growing number of economic and accounting gimmicks called “policy tools”. The center piece of the FED’s monetary policy consists of “administered rates” meaning, the FED creates and manages (manipulates) the money supply through the manipulation of interest rates, bank reserves and the issuance of debt. These manipulative activities are achieved with its authority to “create of money out of nothing” through its Open Market Operations (OMO)in the following ways:

Federal Discount Rate (“discount window” or lending facility) (FDR): allows the FED (and its 12 member banks) to lend money (created out of nothing), directly to “primary dealers” consisting of commercial and investment banks and other depository institutions at interest rates lower than market rates. The Discount (interest) Rate is arbitrarily set by the FED’s Board of Governors and establishes the FED as the “lender of last resort”.

Federal Funds Effective Rate (overnight rate or interbank rate) (FFER): the interest rate depository institutions (all commercial and investment “Banks”) lend their excess reserves (held by one of the Federal Reserve banks) to each other typically on a short-term basis in the overnight market (albeit, in practice rolled over perpetually). Banks borrow in the overnight FFER market to satisfy their short-term payment needs and meet their reserve balance requirements determined by the FED (now at zero percent). The FFER interest rate is the benchmark rate for consumer and business loans (i.e., the prime rate). The FFER is typically lower than the Federal Discount Rate (FDR), albeit, manipulated and managed by the FED’s Open Market Operations to maintain the FED’s perceived “target interest rate”.

Treasury Securities: The FED facilitates the sale of US Treasury Securities (government bills, notes, and bonds and other Securities) in the open market (Bond market) to FED member banks and other eligible depository institutions (foreign and domestic), called “Primary Dealers”. These Treasury Security sales fund the short fall in US Government operations, thereby indirectly increasing the money supply. The sale of Treasury Securities is a major source of deficit spending that compounds the US debit.

Repurchase Agreements (REPO) and Reverse-Repurchase Agreements (RRP) are another “tool” (gimmick) the FED’s OMO uses (more often recently) to facilitate bank liquidity. REPO/RRP agreements are typically used by dealers (generally Banks domestic and foreign) to raise short-term cash, usually between two banks or the FED as a collateralized transaction. When it comes to dealing with the FED, a repo/reverse repo agreement means FED’s OMO trading desk buys or sells Treasury Securities to manipulate the FFER and money supply. In the case of a REPO, a dealer sells government securities to an investor (i.e., the FED, another bank or other financial institution) usually on an overnight or 30-day term and then buys them back at the end of the term (or rolls them over) at a slightly higher price. That small difference in price is the implicit overnight interest rate. The Dollar amounts of these transactions daily are enormous, amounting into the billions of Dollars daily. The key to understanding the size of this market is that, even though the term is short, they are seldom paid back but simply rolled over (a Ponzi game). The immense size of the Treasury Securities outstanding facilitates the collateralization of REPO and RRP transactions in the short-term loan market.

Standing Repo Facility (SRF): On July 28, 2021, The FED established a domestic repo facility, which allows eligible firms, who are mainly large US banks, to quickly convert their Treasuries Securities into short-term cash loans from the FDE. The facility was designed to provide a safety valve for times where liquidity runs short in the “Money Markets”. The securities accepted in SRF operations include Treasury Securities, agency debt securities, and agency mortgage-backed securities. These loans are generally short term (30 days or less), however, subject to roll-over.

Bank Reserves: Typically, the FED requires all Banks (depository institutions) to hold funds in reserve to ensure that it can meet liabilities in case of sudden withdrawal by its depositors (account holders). Reserve ratios (deposit requirement at the FED) is a Monetary Policy tool to increase or decrease the money supply in the economy and manipulate FFER. This means, the higher or lower the “cash reserve ratio” (a percentage of the banks total deposits) determines what a Bank can lend to third parties (defined as, “Fractional Reserve Banking”) hence increasing or reducing debt in the economy, thereby, in this manner, increasing or decreasing the “money supply”. The reserve requirement by the FED has varied through time from a low of 7% to as high as 17.5%. At the time of this writing, the reserve requirement by Banks is 0% of bank deposits (more on this below).

Interest on Reserve Balances (IORB) Following the collapse of the subprime housing market in October 2008, and to facilitate more liquidity for Banks, the FED started paying interest on all “excess” reserves (amounts deposited more than the current reserve ratio) deposited by Banks at any of the twelve Federal Reserve Banks, defined as, IORB at the FFER, which at that time was 0.15% percent. At the date of this writing, the IORB is 5.40%.

Subsequently, in mid-2020 because of high unemployment and the brief collapse of the stock market due to the COVID-19 pandemic and lockdowns, the FED declared zero bank reserve requirements thereby paying IORB on all reserves deposited at Federal Reserve Banks. This zero-bank reserve policy remains in place at the date of this writing.

Bank Term Funding Program (BTFP): On March 12, 2023, (after the collapse of Silicon Valley Banks) the FOMC under the Federal Loan Lending Program, announced the creation of the BTFP, thereby offering loans to eligible financial institutions (small banks, savings associations, and credit unions) through the “discount window” at the FDR up to one-year terms against a wide range of eligible collateral (predominantly Treasury Securities). This allows these financial institutions to eliminate the need to rapidly sell these securities during times of financial stress.

Commercial Paper Funding Facility (CPFF): The CPFF was established by the FED in October 2008 to alleviate the liquidity strain on money market funds (Commercial paper) during the “Great Recession”. The FED opened the CPFF again in March 2020 in response to the steep market selloff and economic uncertainty created by the COVID-19 pandemic. Commercial paper is a critical source of funding for many businesses. It is a commonly used type of unsecured, short-term debt instrument issued by corporations to meet short-term liabilities (payroll, accounts payable and inventories). CPFF are financed directly by the Federal Reserve Bank of New York to purchase three-month commercial paper, both secured and unsecured. This financing scheme was then secured by the assets placed into the SPVs and by the fees paid by issuers of unsecured paper. The US Treasury also provides billion of Dollars of credit protection to the FED in connection with the CPFF from the Treasury’s Exchange Stabilization Fund (ESF).

The FED’s monetary policy schemes described above (i.e., FFER, RPO, REPO, SRF, IORB, BTFP and CPFF) continue to grow in number, adding new acronyms after each Bank liquidity crisis. This plethora of acronyms are nothing more than an extension of FED’s “Discount Window” (FDR), therefore, a “smoke-and-mirrors” potpourri of misleading Bank “bail-out” gimmicks using the FED’s authority granted to it by the Federal Reserve Act to “create money out of nothing”. Therefore, the FED continues to subsidize Bank liquidity through low interest rate loans and deposit guarantees by way of the “discount window”, using the many gimmicks described above and supported by its fiat money “printing press”.

The FED’s “monetary policy tools” (gimmicks) have over time become deeply rooted as the standard means to manage the over leveraged financial industry, particularly during Bank liquidity events. The FED’s “Open Market Operations” (OMO) and the use of its expanding urbane “tool kit” (described above) have become the primary means for implementing fiscal policy by providing risk free Bank liquidity through its “Discount Window”. These FED bank bailout policies have enabled and promoted, over time, a risk adverse banking industry addicted to FED liquidity backstopping and the low cost of capital (low interest rates). Further, these FED policies have incentivized the investment banks to create and sell highly leveraged securitized products resulting in “moral hazard”38

The FED’s first big easy money policy experiment began with the onset of WWI (1914 – 1918). This global world war event allowed the FED to embark on a money printing binge and a low interest rate monetary policy in support of US Treasury bond sales, both domestically and internationally, to finance the war effort. After the war, this easy money policy continued in the name of providing liquidity for the post war economy. This post war low interest rate policy launched an excessive liquidity binge and subsequent economic storm termed the “roaring 1920s”, an economic boom that gave way to unwarranted gains in the stock market, bond market, commodities, manufacturing, and construction. From 1920 to 1929 stock prices quadrupled in value, convincing investors stock gains would never end (sound familiar), resulting in investors (of all types) borrowing heavily on margin to leverage their bets. When the real market was finally exhausted with nothing more to buy, borrow, or mortgage, commensurate with the FED to-little-to-late tightening the money supply (i.e., raising interest rates via the FED funds rate…..sound familiar) or just simply getting out of the market manipulation game, resulted in the evaporation of easy money liquidity, causing the stock market bubble to burst on “Black Thursday”, October 24, 1929. Panic selling ensued, forcing the liquidation of margin accounts, in so doing accelerated the decline of the market indexes, which then precipitated into bank runs. From October to November 1929, the US stock market declined 33%. By the end of 1933, the stock market hit bottom, losing 80% of its value from its high in October 1929. The collapse of the economy and most financial institutions occurred rapidly, a domino effect culminating in the “Great Depression” (1929 – 1941), that didn’t fully end until WWII.

The technical economic reasons behind the cause of the Great Depression are still being debated today. Many economists, following the reasoning promoted by John Maynard Keynes, blamed this massive economic collapse on the “Gold Backed Dollar”. Keynes famously called gold a “barbarous relic” suggesting gold convertibility for Dollars was antiquated and believed a “Gold backed Dollar” provided unwarranted constraints on the FED to expand the money supply during a financial crisis thereby restricting Dollar liquidity and creating bank runs. Followers of Keynes’s economic views believed that any “gold standard” for the Dollar was incompatible with government deficit spending and the FED as the “lender of last resort”.

The Keynesian logic behind the cause of the Great Depression of 1929, being fixated on constraints to the FED caused by the “gold back Dollar”, is an extremely naïve view, bordering on stupidity. When compared side by side to the Great Recession of 2008 (more later), an economic downturn that has gained the distinction of being categorically comparable to the economic and financial collapse, if not worse, to the Great Depression, occurred under the FED with a Dollar with no intrinsic value or “gold standard”. Clearly, there is only one common denominator or root cause, an out-of-control FED that has the manipulative power of the “printing press”.

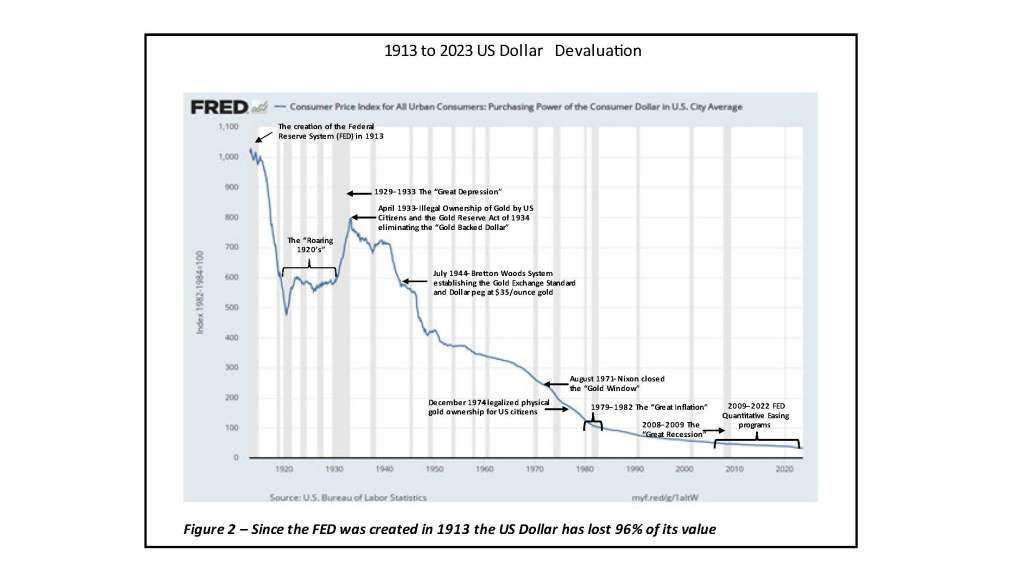

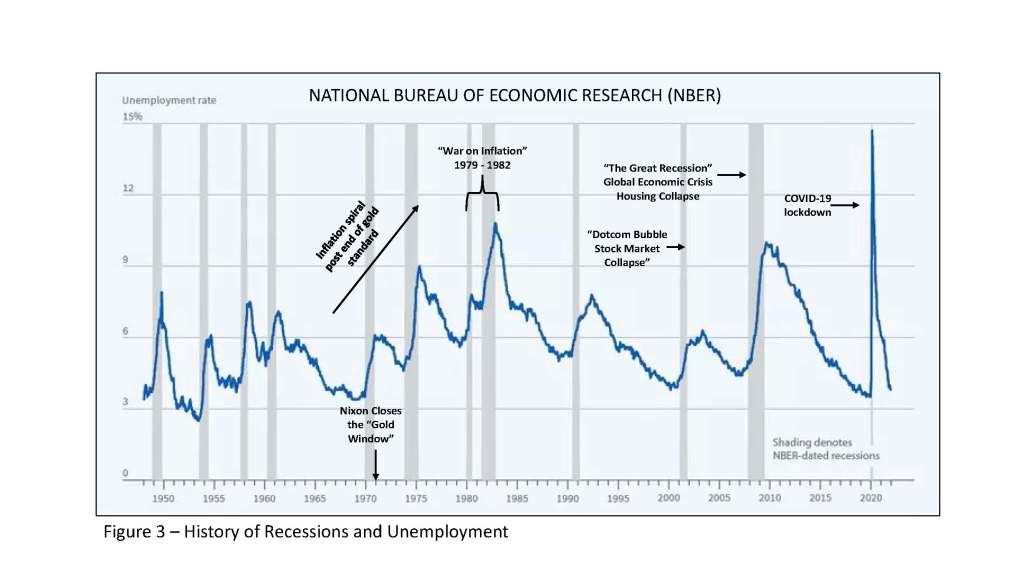

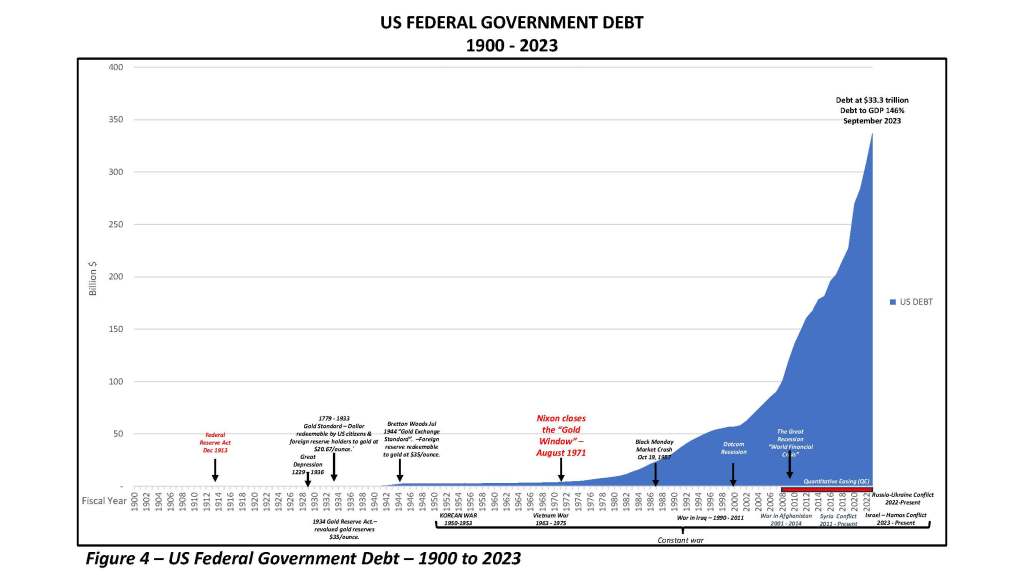

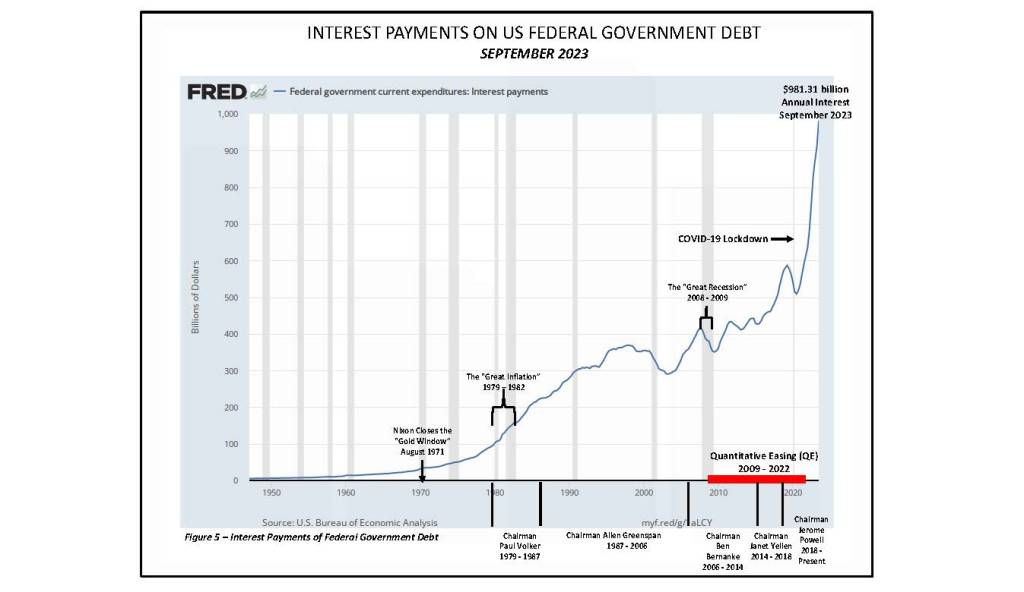

Unfortunately, the FED’s monetary policies implemented during the “Great Depression” solidified its pivotal role in manipulating the US economy’s money supply, interest rates and employment for the next 100 years, Keynesian style. Today, these policies have culminated into a slow and now parabolic rise of public debt, large trade deficit and Dollar devaluation. The proof is in the results, a Dollar that has lost 96% of its value since 1913 (Figure 2), 100 years of rolling recessions (Figure 3), a public debt amounting to + $33 trillion (Figure 4) that consumes 146% of GDP and growing unabated, never to be paid back, and a country at constant war, and debt servicing cost (interest paid on the debt) at $981.3 billion in 2023 (projected to rise +$1 trillion in 2024) (Figure 5) that consumes 40% of US taxes.

The FED accomplished all of this by eliminating the “gold backed Dollar” not because of it. “The Fatal Conceit”.

THE FED – POST BRETTON WOODS SYSTEM

Following the collapse of the Bretton Woods System, from 1971 through 1987, the major global currencies transitioned from “fixed currency exchange rates” to a “floating rate currency exchange system”. Through the mid-1980s, the FED had to maneuver to find a new Dollar footing as a “fiat” currency and, in desperation, to preserve the Dollars “reserve currency” status within the basket of G7 currencies. The new rules of the game in which the Dollar has been revalued as fiat money against the G7 currencies was slowly established in 1985 and 1987 by the Louver and Plaza Accords41 respectively. Although the Dollar maintained its “reserve currency” status, the value of the Dollar as “fiat” has become an abstract, obscure, and idiosyncratic concept, having no anchor to a “store of value”. This has allowed the FED, over the last 50 years, unlimited discretion to “create money out of nothing”, expanding the money supply in a world of low interest rates and floating exchange rates.

According to the US Bureau of Labor Statistics the US dollar has lost over 96% of its value since the FED was created in 1913 (Figure 2). The FED devalues the dollar by increasing the money supply (printing dollars) in the absence of the economy creating value (the need for Dollars). For example, the Dollar value of gold has gone from $35 per ounce in 1971 when Nixon closed the “gold window” at the FED to about +$2000 per ounce today. However, today’s market value of the US Treasury’s gold holdings, if valued at $2000 per troy ounce, is worth $523 billion dollars. This amount falls substantially short of paying off the US debt currently at +$33 trillion.

With the closure of the “US gold window” in 1971, thereby ending the “Gold Exchange Standard”, the market, through the London Gold Market, immediately repriced the Dollar value of gold, going from $35 per ounce in August 1971 to $800 per ounce in January 1980, a 2,200% gain in 9.4 years (Daily Reckoning – Jim Richards -12/11/2023) representing a massive devaluation of the Dollar. Today the gold price is about $2000 per ounce, having a recent high of $2152 per ounce (Figure 6).

As a historical note, all central banks, particularly western Europe, and the US, past and present, collaborate to manipulate the gold price lower, in their goal to maintain blind trust in the “fiat” money system, versus fiscal responsibility. Case-in-point is the London Gold Pool (1961 – 1968), discussed above, that ended with the US closer of the “gold window, turning the Dollar into “fiat” money. During this time the manipulation of the gold price by a cabal of central banks was visibly deliberate, accomplished by selling physical gold into the “open market” (e.g., The London Gold Pool) to maintain the $35 per ounce gold peg. Today, due to the development of high-tech computer programing (algorithms), the manipulation of the gold price by the FED and its band of “bullion bankers” (i.e., London Bullion Market Association-LBMA) continues but is executed within a sophisticated and opaque, commodity based, derivatives market using “digital gold” or “paper gold” contracts. “Bullion banking is fractional reserve banking for gold” (Bullion Star.com) the difference being it is highly leveraged and lacks any transparency.

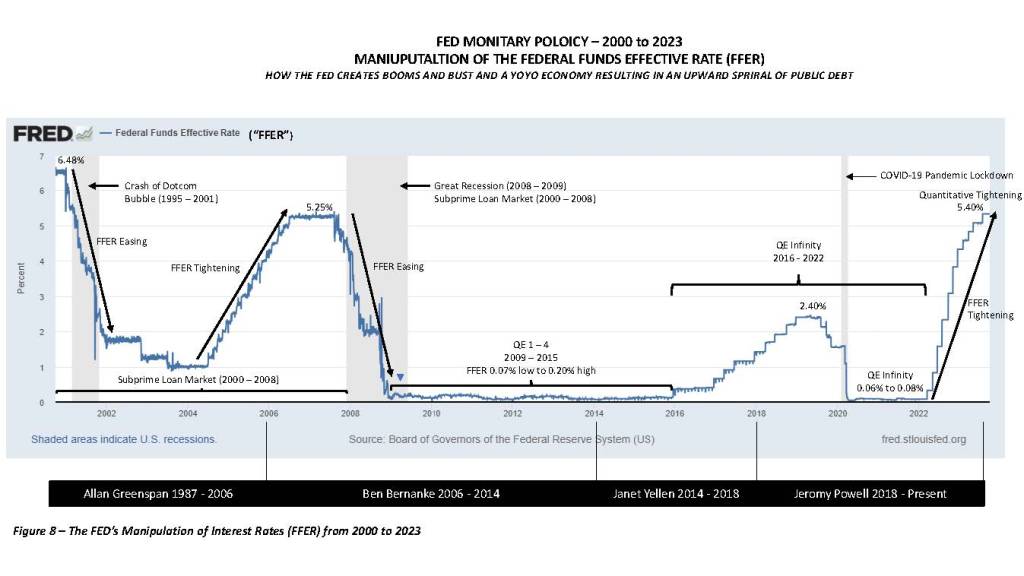

This devaluation of the Dollar, post 1971, resulted in a gradual and then a spike in “inflation” between 1979 to 1982 to 14.5% (termed the “Great Inflation”) and concurrently, a sharply rise in unemployment to >7.5%, peaking at 10.8% in November 1982. Following these extreme economic structural adjustments, the “war on inflation”, a phrase coined by FED Chairman Paul Volker (1979-1987), began in earnest in 1980 with the FED raising the FFER to 19%, spiking consumer loans to 21.5%. This policy decision by FED Chair Volcker and the FOMC eventually reduced inflation to 4% by 1982 and 1% by 1985, albeit, unnecessarily creating high unemployment for the working middle class American and throwing the US economy and global economies into recession from 1980 through 1983.

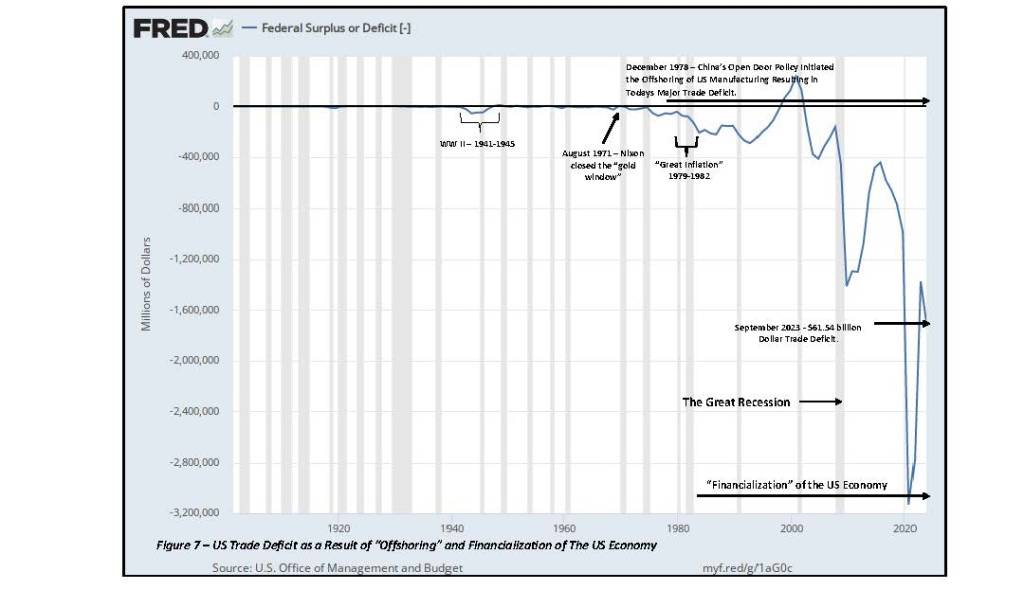

Beginning in the mid-1970s, the Japanese, with their more efficient management style, began out competing the US technology and automotive industries. This was followed in December 1978, when the leader of the People’s Republic of China, Deng Xiaoping (1978 – 1989) announced China’s “Open Door Policy” to businesses wanting to operate in China, marking the beginning of China’s modern economic history. These events lead to the massive “offshoring” (“outsourcing”) of US the manufacturing industry in the 1980s to Asia (predominantly to China), thereby ending the US manufacturing industry and the parabolic rise of its “trade deficit” (Figure 7).

In the mid-1980s, commensurate with the “offshoring” of US manufacturing, the post 1971 new world of “floating rate currency exchange system”, the end of a US “trade surplus” and the beginning of government budget deficits, the US economy was replaced by the great “financialization” of capital markets. These events, brought about by the FED and US Government policy decisions, ultimately resulted in the never-ending stock market bubbles, wage inequity of “blue collar” workers, the subsequent wage stagnation, and the insidious demise of the American “middle class”. The 1980s was the beginning of the “administrative state”, a neoliberal FED policy focused on protecting “financial institutions” and to control the US Banking industry at all costs (i.e., “to big to fail or Jail”).

In a paper by Willian Lazonick, titled “Profits Without Prosperity”, Lazonick discusses the relationship between “value creation and value extraction” and how the change in that relationship redefined the objectives of the FED regarding the corporate world, the stock market and hence the US economy going forward.

“From the end of World War II until the late 1970s, a retain-and-reinvest approach to resource allocation prevailed at major U.S. corporations. They retained earnings and reinvested them in increasing their capabilities, first and foremost in the employees who helped make firms more competitive. They provided workers with higher incomes and greater job security, thus contributing to equitable, stable economic growth—what I call “sustainable prosperity.” This pattern began to break down in the late 1970s, giving way to a downsize-and-distribute regime of reducing costs and then distributing the freed-up cash to financial interests, particularly shareholders. By favoring value extraction over value creation, this approach has contributed to employment instability and income inequality.

Through time the financializaton of the “free markets”42 has become highly creative, driven by the increased sophistication of trading algorithms and derivative contracts, developed by the large investment Banks and management companies (e.g., JPMorgan Chase, Bank of America, Morgan Stanley, Wells Fargo, Goldman Sachs, Charles Schwab, Citigroup, etc.). Beginning in the late 1970s and 1980s investment management companies hired more computer programs than economists and financial advisors. This trend provided the programming technical expertise to create an endless array of algorithms to advance an active OTC derivative and “quantitative trading” (quant trader) market. This computer technical expertise (financial engineering) allowed the “investment banker” to escalate the development of new “securitized financial products” (securitization43) in the 21st Century. This trend has become highly institutionalized in the investment management industry to where the need and purpose continue without question as this activity satisfies the implementation of risk-free capital provided by the FED and a constant rising stock market. From the mid-1980s through the 2000s, new derivative and securitized trading products have been developed by the “quant traders” and supported by the FED’s monetary policy in the form of low short-term interest rates (FFER) (Figure 8). The FED’s “open market” purchase of Treasury Securities (debt monetization) and Mortgage Backed Securities (MBS) from 2008 to 2022 provided an endless feedback loop of capital back to the investment banks and Primary Dealers, perpetuating the continued rise in stock and bond markets and, and the suspected but unverified price capping (short selling) of commodities (e.g., agriculture, metals, precious metals, oil, and gas), particularly precious metals in the derivatives market. For example, in Q3 2023 the FED held $4.96 trillion in Treasury Securities (US Government debt) and $2.480 trillion in agency MBS (Figure 8). Further, from May – June 2020 the FED bought up $750 billion in shares of bond ETFs via the Secondary Market Corporate Credit Facility (SMCCF)44.

Under FED Chairman Alan Greenspan (1987-2006) and following the October 19, 1987 stock market crash (Black Monday) the SEC implemented Rule 80B commonly referred to as “trading curbs” or “circuit breakers”45. These SEC rules are designed to temporarily halt stock market trading to minimize panic selling and stock trading volatility. Rule 80B was amended in 2013 following the “Flash Crash” of May 6, 2010. Under “free markets” these manipulative gimmicks would not exist. Highly volatile markets only exist due to the FED’s low interest rate policies promoting cheap money, resulting in extreme speculation in the stock market by investment management firms, individuals and “high frequency trading” firms. These highly speculative events should be left to deleverage naturally as they have nothing to do with the real economy. If left to run its course, high market losses by investors would realign risk adversity providing the natural breaks required, hence abating highly speculative and over leveraged markets (“moral hazard”). By providing “circuit breaks”, stock market trading hubris is encouraged and represents nothing more than another “bank bailout” mechanism at the tax payors expense.

With the rapid advance of the internet and digital technology, the “financialization” of the investment management industry has been refined, over the last four decades, into a highly creative and sophisticated securities trading industry. This trend represented “Wall Street’s” and the FED’s overall commitment to the movement of capital into short-term financial investment and profit, a trend toward increasing capital formation through debt (the elimination of savings and thrift), and the creation and sale of highly sophisticated and complex financial instruments known as securitization and commonly grouped as “asset-back securities” (ABS). This trend strengthened and accelerated through the 1990s and 2000s which, with the help of the FED’s easy money policies throughout this period (Figure 8) precipitated the “Dot-Com” stock market bubble and the 2007 – 2008 subprime loan and global economic crisis (the “Great Recession”) (more on this below).

In 1982, further perpetuating the “financialization” of the US economy, the Securities and Exchange Commission (SEC) instituted Rule 10b-1846 of the Securities Exchange Act allowing corporations, as reporting issuer on the Stock Exchanges, to repurchase, in the “open market”, up to a certain dollar amount of their shares over a specified period or open-ended period, commonly referred to as “stock buyback programs”. The stock buyback rules only state that the repurchase amount does not exceed 25% of the previous four weeks average trading volume, however, the listed companies are only required to report total quarterly repurchases but not daily, hence stock price manipulation either out of omission or commission, went unnoticed. Stock buyback programs by big publicly traded corporations has been one of the key drivers of the never-ending stock market bubble since the mid 1980s and the manipulation of free markets using unallocated revenue of corporate America. During that period 2003 – 2012, 54% of company earnings on the S&P 500 index, totaling $2.4 trillion were used to buy back their own stock, almost all through purchases on the open market47. Dividends absorbed an additional 37% of company earnings. That left very little for investments in productive capabilities. This further supports Lazonick’s premise whereby corporate America has gone from “retain-and-reinvest” revenue strategy to “downsize-and-distribute” revenue strategy. This strategy has resulted in the continual transfer of revenue from the production sector to the financial sector, resulting in high share prices, unrealistic (fraudulent actually) higher earnings per share (EPS), higher stock dividends to shareholders and higher option awards to corporate leadership. One of the most insidious results of “stock-buyback programs” is a high percentage of the company’s buy back shares, once cancelled, have been redistributed back as stock option awards to corporate executives (CEO, COO, CFO, etc.).

In 1985, the FED began allowing bank holding companies to own a variety of financial institutions (banks, insurance companies, investment management firms) in multiple states (across state lines). This was further extended by the 1994 Riegle-Neal Interstate Banking and Branch Act48 resulting in the concentration of financial activity in fewer and larger banks due to bank mergers across State lines. This was followed in 1999 by the partial repeal of the 1933 Glass-Steagall Act49 referred to as the Financial Services Modernization Act (Gramm-Leach-Bliley Act) making it legal for commercial banks, investment banks and insurance companies to operate as a single entity in all financial markets across state lines through a common holding company (such as Black Rock Inc., Vanguard, JP Morgan Chase, Bank America, etc.). The appeal of the Glass-Steagall Act effectively let the “fox in the henhouse” as it existed during the “roaring 1920s” and the catalyst for the “Great Depression” (1929-1933). To make matters worse, the FED was appointed in charge of oversight.

During the 1990s through 2000s the FED and SEC reduced their oversight roll and essentially became “cheerleaders” for financial service and investment management firms to create new financial products such as Mortgage Back Securities (MBS), Collateralized Debt Obligations (CDO), credit default swaps (CDS), over the counter (OTC) derivatives, off-balance sheet transactions and “shadow-banking”50 activities that went largely unregulated and viewed as private transactions. All these complex financial gimmicks played a major role in the Dot-com bubble and the October 2008 collapse of the “subprime mortgage loan market” resulting in the 2008 – 2009 Great Recession. In 2023, the size of the US CDS market, a form of “shadow banking”, was >$4.3 trillion. In 2022, the global size of the “shadow-banking” industry was estimated to hold assets of over $239 trillion or 49.17% of the total financial sector. Further, commercial banks held $1.2 trillion or 53% of US GDP in 1985, accelerating to $11.8 trillion or 84% of GDP by 2007.

The creation of OTC commodity related derivatives are complex financial contracts, the prices of which are touted by the investment management and banking establishment to be derived from the underlining physical commodity prices traded. This is just false, particularly with precious metals, as the derivative commodity contract volumes traded against the physical market far exceed the actual existing physical commodity volumes traded, meaning the physical cash commodity prices quoted in the market are highly linked to the derivative (paper) contract prices, not the other way around. This is the worst form of “free market” price manipulation and “Statism”.

It is suspected but unverified that the FED, with the assistance of the Treasury, intervenes in the “free markets” through the trading desks of securities dealers, banks, and buy-side firms (i.e., Primary Dealers, investment Banks and investment management companies such as JPMorgan Chase, Goldman Sachs, Bank of America, and Morgan Stanley, etc.). Further, the Federal Reserve Bank of New York sponsors the Treasury Market Practices Group (TMPG)51, consisting of a consortium of “professionals” designed to advise and support the efficiency of the Treasury Security and MBS markets. The FED may also collaborate with the “Working Group of Financial Markets”52 commonly referred to as the “Plunge Protection Team” (PPT). The PPT was formed in 1988 during President Ronald Regan’s (1981 -1989) administration and under FED Chairman Alan Greenspan (1987-2006) after the October 19, 1987, stock market crash (Black Monday). In theory, the PPT’s mission is advisory to the US President to provide information on stock market stability. However, some speculate that the PPT actively intervenes to prop up stock prices and cap commodity prices, particularly precious metals. The PPT’s lack of transparency contributes to this mystery. However, the FED does have a “principal-agent relationship” with securities dealers (i.e., the FED has a broker), which would allow the US Government to directly intervene into “free markets” (i.e., stock, bond, and commodity markets) utilizing the FED’s ability and authority to “create money out of nothing”, being unregulated with almost no oversight. The FEDs intervention into “free markets”, using its “money printing” bottomless wallet, would create significant marketable security price distortions, making any correction, either up or down, a major financial event or crisis, respectively. This would never happen in a “free market”.

The “financialization” of the US economy has no redeeming value for the working middle class American and the non-financial sector of the economy, as it has created inequitable income distribution, resulting in disproportionally high investment bank executive salaries versus low blue collar workers wages. Two of the most egregious outcomes being the concentration of wealth to the top 1% of the population and the destruction of savings, thrift, and wage inequality for the working middle class American. Financialization has distorted wage income distribution and job creation, whereby wages in the financial sector have surged, versus workers in the industrial sector. Also, starting in the late 1980s, a large component of the senior corporate executives was driven by stock-based income, not experienced by labor wage earners. For example, in 1991 the SEC allowed corporate executives to keep capital gains resulting from selling stock acquired from stock options. This rule has promoted insider self serving behavior given executives the opportunity to trade company shares when undisclosed daily company buybacks are happening. The results of these egregious policies have created a world of greed whereby share holders, corporate executives, “deep state” and the FED are focused on stock price gains not productivity.

Following the “financialization” and “offshoring” of the US economy in the mid-1980s, as described above, the FED, under the leadership of Chairman Allen Greenspan, became opaquer and operating more indiscriminately in the private sector. By the early 1990s, the FED had firmly established its control over the economy through the manipulation of interest rates, the money supply, the monetization of Treasury debt and solidifying its use of the “discount window” as the “lender of last resort” resulting in more Bank bailouts. Commensurate with the FED’s less than transparent Open Market Operations, from the mid-1980’s to the present, the US Government grew to become a large authoritarian centralized behemoth, a neoliberal plutocracy with no checks-and-balances by Congress, a government seemingly controlled by an opaque small group of powerful lobbyists, an autocratic bureaucracy (“deep state”), and special interests (big banks and corporations). Over time this big government approach, coupled with the “financializaton” of the economy, has created a greed obsessed and corrupt business culture resulting in an economy of diminishing returns, a government debt level that can never be paid back (Figure 4), a large government bureaucracy that is unaccountable to Congress, a vastly shrinking middle-class working Americans and a homeless population that is now growing parabolically.

The FED’s easy money monetary policies carried out in the late 1950s through the 1960s (e.g., Korean War, Vietnam War, and Johnson’s and Nixon’s “Great Society” programs), culminated in 1971 when President Richard Nixon (1969 – 1974) closed the “gold window” (discussed above), thereby removing the $35 per ounce gold peg to the Dollar, ending the Bretton Woods System. By ending the gold – Dollar peg, the Dollar became “fiat” money as part of G7 “floating rate currency exchange system”, thus removing the FED from all “money printing” constraints and transparency. The decades following the “Nixon shock” commence the era that redirected the FED’s monetary policies and the US Government’s economic policies (the “deep state”) from a production driven economy to the new world of financial investment. And so, from the 1970s through the 1980s, the US economy began “offshoring”39 the US manufacturing and mining production capabilities to Asia and other parts of the world. To fill this economic void, the US transitioned from an export production-based economy to an administrative state and service economy, thereby commencing the “financialization”40of the US economy by the investment banking industry (more on this below). These two major economic structural changes, among other things, over the last four decades has concentrated wealth to the top 1% of the population, exacerbated the demise of the “middle class” American, creating wage inequality and wage stagnation, eviscerated the value of the Dollar, free markets and sound money principles as described below:

As described above, from 1971 through 2022, the FED’s opaque monetary policies have been highly influenced by big investment Banks and corporate America in a self-serving manner to satisfy “Wall Street’s” need for never-ending stock market gains and bond market liquidity, resulting in the destruction of American savings and thrift. The epoch from 1987 – present, historically marks the death of sound money principals and free markets (i.e., the “death of capitalism”) and the parabolic rise in US debt (Figure 4). The “financialization of everything” and the final degradation of “free-markets” began first under the leadership of FED Chairman Allen Greenspan (1987 – 2006), followed by Chairman Ben Bernanke (2006 – 2014), Chairman Janet Yellen (2014 – 2018) and currently Chairman Jerome Powell (2018 – Present). Encouraged by the easy money monetary policies of the FED, the US Government has experienced a parabolic rise of the “neoliberal” administrative state (government bureaucracy or “Deep State”), and the creation and growth a plutocracy (1% wealthy elite).

THE GREAT PONZI GAME

To put the above discussions into perspective, the “Subprime Mortgage Housing Market” bubble, occurring from 2000 to 2008, highlights and epitomizes the FED’s culpability in creating economic “moral hazard”. Through its loose monetary policies (low interest rates) over the previous three decades and ignoring the financial industry’s ability to create highly leveraged investment products (i.e., financialization of the economy in the absence of manufacturing and production) a housing market debt bubble of unprecedented level ensued. The unfolding of this economic calamity epitomizes the FED’s arrogance (“The Fatal Conceit”) and ability to manipulate interest rates (Figure 8) to the detriment of a free market economy. The FED’s Open Market Operations (OMO), from 2009 – 2022 morphed into a highly sophisticated opaque “state run” Ponzi game53described as follows:

From 2000 – 2008, home sales and home mortgages expanded parabolically, promoted by the President George W Bush (2001 -2009) White House, having a goal to reach 68% home ownership to the American public (National Affordable Housing Act40). This objective created a housing boom that was accelerated by commercial banks and mortgage brokers, promoting below prime interest rates for home mortgages to prospective home buyers, hence called the “subprime mortgage loan market”54. The catalyst for this housing boom was the low interest rate environment (Figure 8) facilitated by then FED Chair Alan Greenspan’s accommodative interest rate policy from 2000 – 2005.

Subprime home loans were structured having below “Prime Rate” home mortgage interest rates upon loan origination (hence the term subprime loans) then accelerating substantially several years later. New home buyers wanted to capitalize and speculate (house flipping) on this unique interest rate environment without considering the longer- term increased interest rate liability. The logic that characterizes the US housing market is that home values always trend upward thereby mitigating any increased liability for the future rise in mortgage interest.

Investment Banks and other mortgage brokers, in their desire to get in the game and further their self-interest to capitalize on the FED’s accommodative monetary policy, packaged and then securitized a complex mix of “Subprime loans” into bonds called Mortgaged-Back Securities (MBS) and then Collateralized Debt Obligations (CDO). By mid-2008 more than 60% of all US mortgages were securitized as MBSs and CDOs, hence opaque tranches of interest income securities that were then sold to investors and other investment institutions (Investment Banks globally and domestically), further leveraging this speculative environment.

Starting in 2006, higher mortgage interest rates from subprime home loans started to kick in. This coincided with Chairman Alan Greenspan’s less accommodative interest rate Open Market Operations (due to the “dot com” stock market bubble, prompting Greenspan’s “Irrational exuberance” statement) forcing a rise in the Federal Funds Effective Rate (FFER), historically referred to as “taking away the punch bowl”55.

By 2007 the subprime loan market (MBS) started to melt down because of rising interest rates, thereby reducing the demand for new homes (domestic and globally). This change in “monetary policy” by the FED combined with the structured rise in subprime loans created a cascade of homeowner and speculator loan defaults, resulting in the collapse in home prices. A domino effect ensued, creating a collapse in the MBS and CDO market, hence an enormous liquidity crisis for investment banks and mortgage brokers (domestic and foreign) that culminate in the “Great Recession” starting in 2008 to 2009 [note: this is the official dates for the Great Recession determined by the Federal Government. This author believes the term “global economic crisis” was blatantly mis-managed and was essentially obfuscated by QE. For the middle class American, the Great Recession continues to devalue their financial lifestyle].

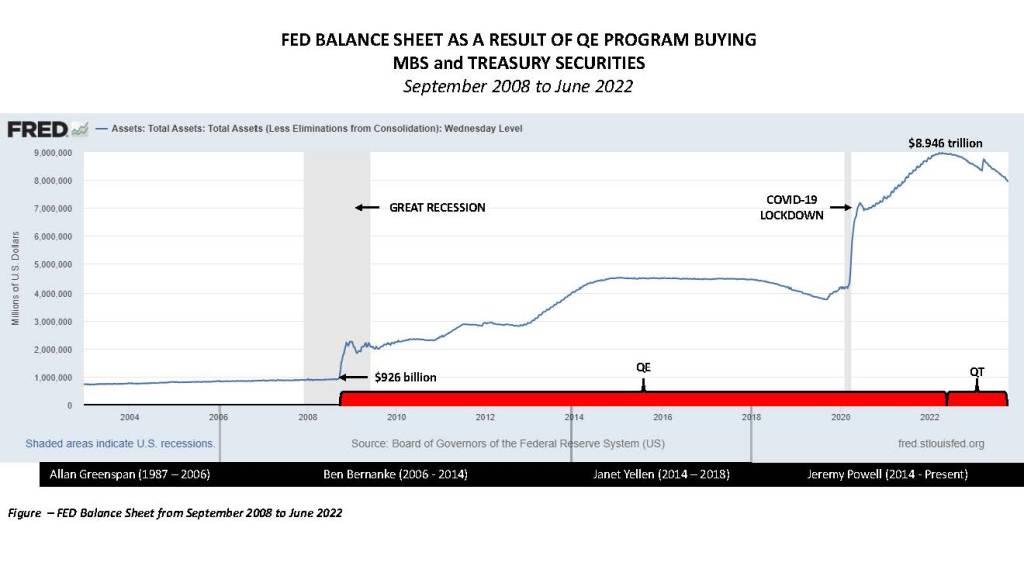

Next, in October 2008, when Bank liquidity was collapsing due to “subprime mortgage” delinquencies and the stock market was imploding, combined with the bankruptcy of Lehman Brother in September 2008 (due to Lehman’s over leveraging its balance sheet with MBS) the new FED Chairman Ben Bernanke along with his White House cronies panicked. In the FED’s effort to rescue the over leveraged Banking and mortgage industries, verses letting the overleveraged market participants collapse and run its course, FED Chairman Bernanke came up with an unconventional “monetary policy” gimmick called Quantitative Easing (QE) (not a new scheme, this debt monetization gimmick was used by prior FED Chairman and certainly extensively used in Japan for decades, albeit by different names).

FED Chairman Bernanke’s QE scheme amounted to the FED buying, in the “open Market”, Treasury Securities previously purchased by the Primary Dealers, and MBS from Investment Banks and Mortgage Brokers using “money create out of nothing”. This QE scheme began in November 2008 and continued through December 2013, called QE 1 through 4 (Figure 6). This bailout operation provided massive amounts of liquidity to the Banks, amounting to $85 Billion per month for 5 years, totaling $5.272 trillion to the FED’s balance sheet (Figure 7) and most egregious, keeping alive the perpetrators of this calamity. The FED held the FFER from 2009 – 2016 (8 years) between a low of 0.07% to 0.20% (Figure 6).

In 2022, about 78% of the US Governments expenditures, amounting to $6.3 trillion, were paid from the collection of $4.9 trillion in taxes and the remaining 22% or $1.4 trillion from the sale of debt in the form of Treasury Securities (CATO Institute – April 18, 202356). The FED facilitates the sale of Treasuries Securities through its system of Primary Dealers operating as Direct and Indirect buyers of US Treasury debt. The FED then, particularly during QE (2008 – 2022), repurchases the debt securities back, from the Primary Dealers and other financial institutions using its authority to “create money out of nothing”. The Treasury Security buy-back scheme is nothing more than the FED “monetizing the debt” with “money created out of nothing” …..the ultimate “Ponzi Game”.

Along with QE, on October 3, 2008, Congress passed the Troubled Asset Relief Program (TARP)57 spearheaded by Henry Paulson, the Secretary of the Treasury. TARP consists of a $475 billion Dollar taxpayer funded Bank and corporate bailout programs (the most egregious being AIG and GMAC) consisting mostly of purchasing marketable securities in the open market and corporate loans.

The FED’s buy-back (bail-out) “money printing” activity continued from 2014 – 2022, under different names and narratives, described by the investment industry as “QE Infinity”. This FED buy back “money printing” operation continued for another 8 years at the rate of about $20 Billion per month for purchasing MBSs (through December 2021) totaling $1.883 trillion and about $23 Billion per month for Treasury Securities (2014 – 2023) for 10 years totaling $2.749 trillion44 (Figure 8 and 9).

From September 2008 to April 2022, the FED’s balance sheet had gone from about $926 billion Dollars to about $9.0 trillion Dollars45(FIGURE 9). The majority of the FED’s “assets” on its balance sheet are now made up of Treasury Securities, Mortgaged-back Securities, corporate bonds, ETFs, and other marketable securities, all purchased from “money created out of nothing”. To put this into perspective, the FED’s balance sheet ballooned $8.0 trillion Dollars over 15 years; a capital injection into Banks at the rate of $45 billion Dollars per month. This represents a blatant use of “money created out of nothing” to compete against free market investors representing an insidious distortion of free market “price discovery”.

Following the collapse of the subprime housing market in October 2008, and to facilitate more liquidity for Banks, the FED started paying interest on all “excess” reserves deposited by Banks at any of the twelve Federal Reserve Banks, defined as Interest on Reserve Balances (IORB), at the FFER, which at that time was 0.15% percent. At the date of this writing, the IORB is 5.40%.

Next, in mid-2020 because of high unemployment and the brief collapse of the stock market due to the COVID-19 pandemic and lockdowns, the FED declared zero bank reserve requirements thereby paying IORB on all reserves deposited at Federal Reserve Banks. This zero-bank reserve policy remains in place at the date of this writing.

Now that Banks can earn risk free interest on their un-loaned reserves (your deposits), debt/credit has been removed from the economy, creating a dramatic decrease in the M2 money supply, occurring from 2020 to present. Hence, a lower money supply drives up demand for capital resulting in higher interest rates. At the time of this writing the FED pays interest at the IORB rate, amounting to 5.40%, on reserve balances totaling $3.335 trillion (September 14, 202347), which amounts to $44.058 Billion in interest payments to Banks for the quarter ended June 30, 2023, or about $176 billion annually in interest payments to Banks.

The interest payments by the FED on reserve balances to Banks now exceed interest income the FED receives from its balance sheet investments, consisting primarily of loans to depository institutions, Treasury Securities and Mortgaged-Backed Securities. For the first time in history, the FED has a net interest expense amount of $29.439 billion Dollars for the quarter ended June 30, 2023 (FED Quarterly Report58) hence, more “money printing” by the FED to pay interest to Banks on their reserve balances.

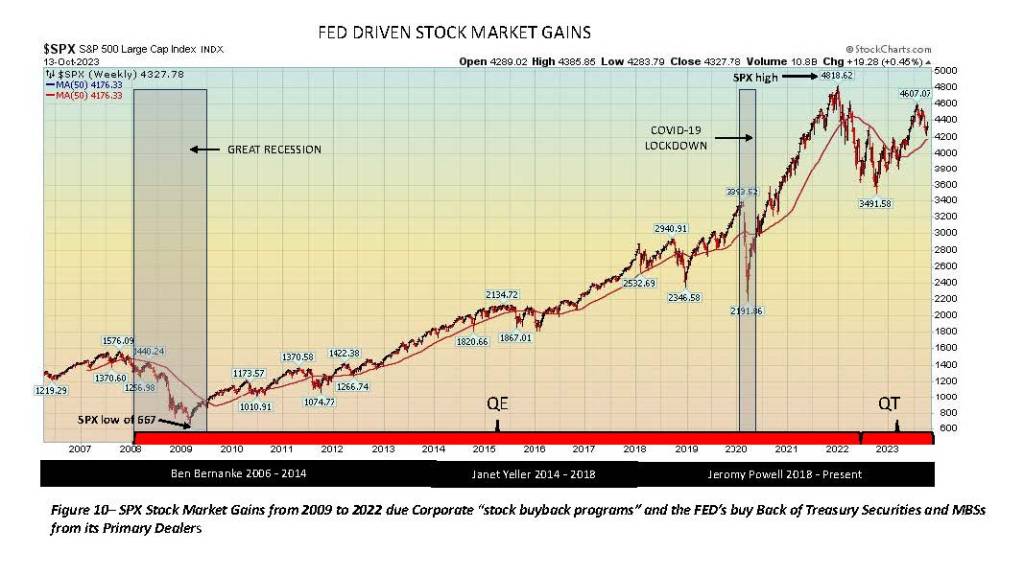

As described above, from 2008 to 2022 the FED embarked on an infinite number of market manipulation schemes using its authority to “create money out of nothing”. The FED’s QE operations through this period-maintained supper low FFER at <0.25%, resulted in injecting massive amounts of cheap capital into the Banking industry (investment banks and other financial institutions). This “money printing exercise” triggered a never-ending stock market bubble, resulting in moving the S&P 500 Large Cap Index (SPX) from 667 in March 2009, the stock market low from the Great Recession, to a high of 4,819 at its peak in January 2022. This advance in the prices of marketable securities amounted to a gain in S&P 500 of 722% or 55.6% return per year over this 13-year period59(the rich get richer) (FIGURE 8).

As a result of the FED’s QE low interest rate policy decisions from 2008 – 2022, in 2020 the inflation rate (Dollar devaluation) started moving precipitously upward from around 2% per annum in January 2020 (the FED target rate) to an interim peak of 9.1% per cent by June 2022. After several boughs of denial (inflation is transitory) and procrastination, the FOMC under FED Chairman Jeremy Powell in June 2022 began raising the FDR, in quarterly increments starting at 0.75% in what has been termed Quantitative Tightening (QT). From a low FFER of about 0.08% percent through most of 2020 to 2022 to a high of 5.40% in August 2023. At the date of this writing, the FDR (determined by the FOMC) is 5.50% and the FFER is 5.33% (Figure 6).

Now, under the guidance of FED Chairman Jeromy Powell’s, interest rate tightening, or Quantitative Tightening (QT) has been implemented, a “rinse and repeat” process, theoretically designed, according to the FED, to bring inflation and Federal Funds Effective Rate (FFER) back to target levels.

CONCLUSION

Since the creation of the FED on Jekyll Island in 1910 and the passage of the Federal Reserve Act in 1913, the ensuing 110 years (1913 – 2023) have undergone a slow but accretive wearing-away of “sound-money principles”, “free-markets”, and the creation of a “fiat” Dollar having lost 96% of its value. I call this the “death of capitalism”. Since the mid-1980s, commensurate with the disingenuous “Offshoring” of the US manufacturing industry, the FED’s aggregate low interest rate “monetary policy” gimmicks, interstate banking and the repeal of the Glass Steagall Act promoted the “financialization” of the US economy for the sole benefit of “Wallstreet”, the investment banking cabal, and the top 1% of the population. Many would call this “capitalism” and they would be wrong.